new mexico solar tax credit 2020

The credit disappeared for four years but was reinstated in 2020. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

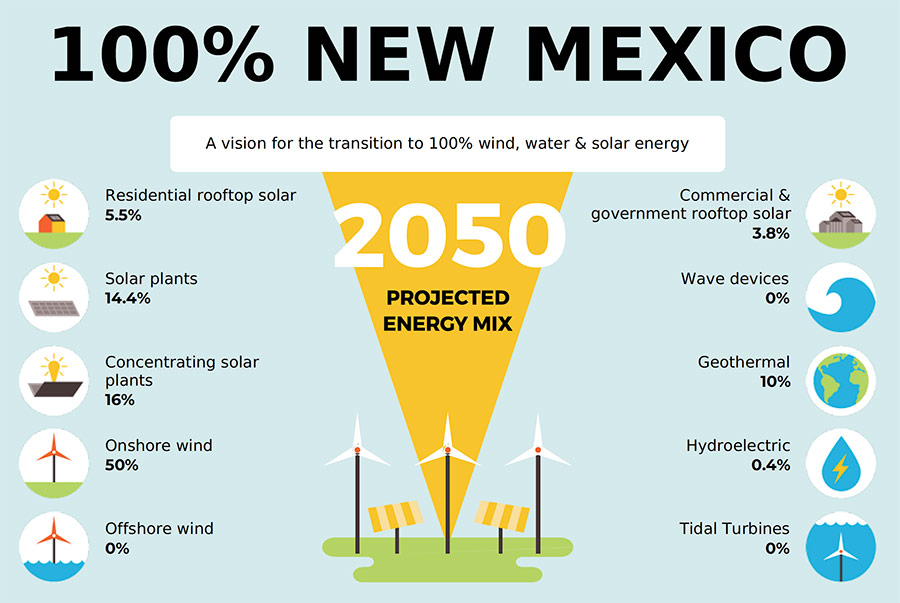

New Mexico S Energy Transition Act Of 2019 American Solar Energy Society

The credits available in the Land of Enchantment come at an opportune time since the 26 Federal Investment Tax Credit ITC decreases at the end of 2020.

. New Mexico Solar Tax Credit 2020. It covers 10 of your installation costs up to a. Note that solar pool or hot tub heaters are not eligible for this tax.

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. This area of the site. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

The Renewable Energy Production Tax Credit REPTC NMSA 1978 7-2A-19 has sunset but created a significant incentive for economic development in New Mexico attracting utility. Or solar-heat-derived qualified energy resource the amount of tax credit varies based on the tax year following the date Page 1 of 3. The new Solar Market Development Tax Credit policy also known as the New Mexico solar tax credit provides a tax credit of 10 for small solar systems.

Solar Market Development Tax Credit SMTDC EMNRD is in the process of reviewing the provisions in the amendments made to the New Solar Market Development Tax Credit during. It provides a 10 tax credit with a value up to 6000 for a solar. If you installed your solar panels after March first of this year and your system is certified by the New Mexico Energy Minerals and Natural Resources Department youre.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. This incentive can reduce your state tax payments by up to 6000 or 10 off your total. The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022.

As of 112020 the first year of the tax reduction started with a 4 drop from the initial 30 credit to 26. Hearing scheduled April 29 on new. Payment deadlines approaching for 2020 tax relief.

To be eligible systems must first be certified by the New Mexico Energy Minerals and Natural Resources Department. New Mexico Solar Tax Credit. Homeowners throughout New Mexico can qualify for a 10 tax credit that.

The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature. The 10 state solar tax. Solar Incentives Tax Credits and Rebates in New Mexico.

29 is for 10 percent of the.

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

New Mexico Seeks Share Of 1 Billion In Energy Savings Via Solar Power Program

Solar Rebates And Solar Tax Credits For New Mexico Unbound Solar

Solar Power In New Mexico All You Need To Know

Solar Power In New Mexico All You Need To Know

Federal Solar Tax Credit What It Is How To Claim It For 2022

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Guide To New Mexico Incentives Tax Credits In 2022

New Mexico State Solar Tax Credit Offers A Promising Addition To The Growing Industry Novogradac

2022 New Mexico Solar Incentives Tax Credits Rebates More

New England Solar Power A Guide To Solar Energy In These 6 States Cnet

Almost 2 000 Solar Tax Credits Approved In New Mexico

Easy Solar Tax Credit Calculator 2021

Solar Investment Tax Credit Extended At 26 For Two Additional Years

Here S How Solar Panels Can Earn You A Big Tax Credit Cnet